Stocks and Securities

Stocks and Securities

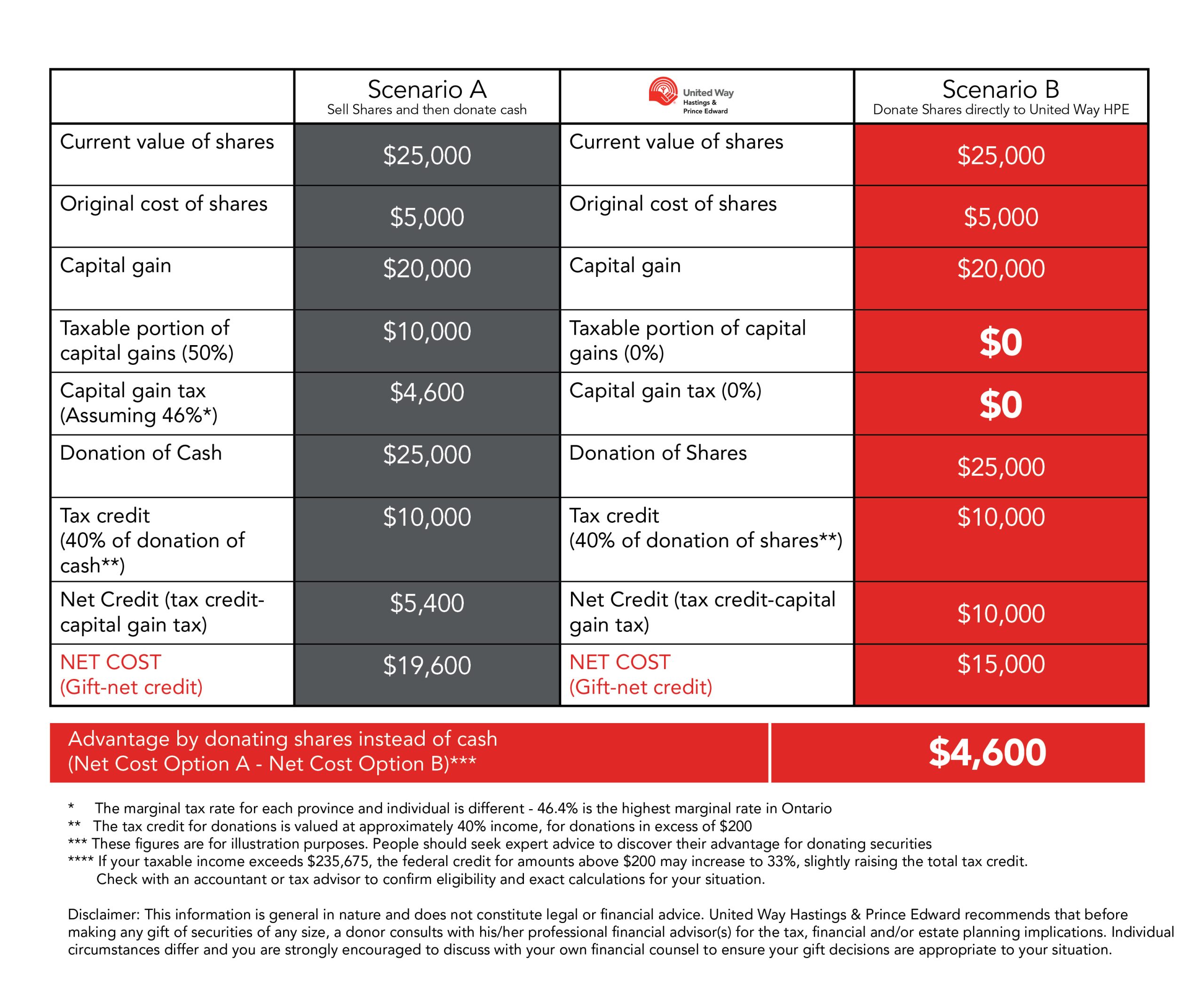

Donating publicly traded stocks and securities is a tax-smart way to support United Way HPE, whether you do that now, or through your estate. You will receive a charitable tax receipt for the fair market value of the donated security and you will not pay tax on any capital gain.

You can support the communities greatest needs or you may designate your gift to a priority that meets your interests.

Benefits of gifts of stocks and securities:

- The capital gain inclusion rate is zero when eligible stock or securities are donated directly to United Way HPE. If you sell the shares and donate the proceeds, you will be required to pay capital gains tax.

- The value of your charitable tax receipt will be based on the market closing price on the day that United Way HPE receives your stock or securities in its brokerage account.